Received PPP Funds? Your questions answered.

Clyde’s DC | Photo by Sarah Gerrity

The last few weeks have been quite a journey, but this week is the beginning of a new chapter. Some are finally coming to find out that the PPP loan is not a mystical fantasy, and funds are on the way.

Raffi Yousefian, MarginEdge’s (and countless other restaurants) trusted accountant, has done an incredible job navigating restaurants through the nuances and complexities of the PPP and its debt forgiveness component. This is our effort to distill what we know about guidelines as they continue to come into focus. Here is what we will cover:

- Recap the rules as we understand them

- Lay out four scenarios for restaurants and the impact of PPP on each

In short order, we hope to have three additional posts covering the impacts of unemployment insurance on the PPP, creative and effective ways to deploy your PPP funds, and the specifics around documentation as you begin to think about reimbursement. Stay tuned.

For now, let’s dive in.

Let’s assume your PPP loan application has been processed and approved —what are the next steps and how can you prepare?

SBA requires that lenders disburse funds within 10 days of loan approval. At a high level, and what most of us know is that 75% of the loan proceeds must cover payroll costs. The remaining 25% can be used for utility payments under service agreements, rent on leases, or interest on a mortgage or other debt incurred (all dated before 2/15/20).

The loan will be forgiven and will act like a grant for costs incurred and payments made that meet these criteria within the 8-week period following disbursement of the loan (except for interest on non-mortgage debt).

The unforgiven amount will convert to a two year 1% loan from the date the borrower applies for loan forgiveness. You will not have to make any payments towards principal or interest for six months following the date of the disbursement of the loan, although interest will accrue during this time. The lender is authorized to defer payments for up to one year depending on how the pandemic unfolds. There will be no prepayment penalties, guarantee fees, or yearly fees.

What will impact the amount that is forgiven?

- If you reduce your workforce during the 8-week period.

- This is calculated by comparing the number of average full-time equivalent (FTE) employees for each pay period during the 8-week period to the average number of FTE employees between either January 1, 2020 – February 29, 2020, or February 15, 2019 – June 30, 2019.

- The reduction in loan forgiveness for reducing your workforce will not apply if you laid off your workers between February 15, 2020 and April 27, 2020 (30 days after the enactment of the CARES act), then restore your workforce by June 30, 2020. You can restore your full workforce at any point before June 30th.

- If you reduce the salaries/wages to employees making less than $100k annually by more than 25% during the 8-week period.

As so many of us have pivoted our models, this is a particularly important note. If you laid off or furloughed your staff, there’s nothing in the bill that states you’re required to rehire the same workforce or for the same purpose (pending confirmation from SBA guidance). You can hire employees who would be more suited for your current operations.

For example, if you need delivery drivers instead of bartenders, then you could either hire delivery drivers or repurpose your bartenders as delivery drivers in order to meet forgiveness requirements.

Let’s work through a couple of industry specific examples to see how this plays out.

For the sake of simplicity, we will treat 4 weeks and a month as the same, assume no employees are paid over $100k, all delivery is done by a third party delivery service, and assume all other variables are constant.

Snapshot of our sample restaurant:

Pre-COVID:

Monthly Sales: $120,000

Monthly Payroll: $60,000 ($24k tips and $36k in wages)

Rent: $7,200

FTE: 20

Post COVID:

Monthly Sales: $30,000

Monthly Payroll: $15,000 ($6k tips and $9k wages)

Rent: $7,200

FTE: 5

On April 20, they had $0 in cash, but were awarded $150k (2.5 months average payroll) in PPP loan proceeds.

Between April 20 and June 15, they spend $30k on payroll and $14.4k on rent.

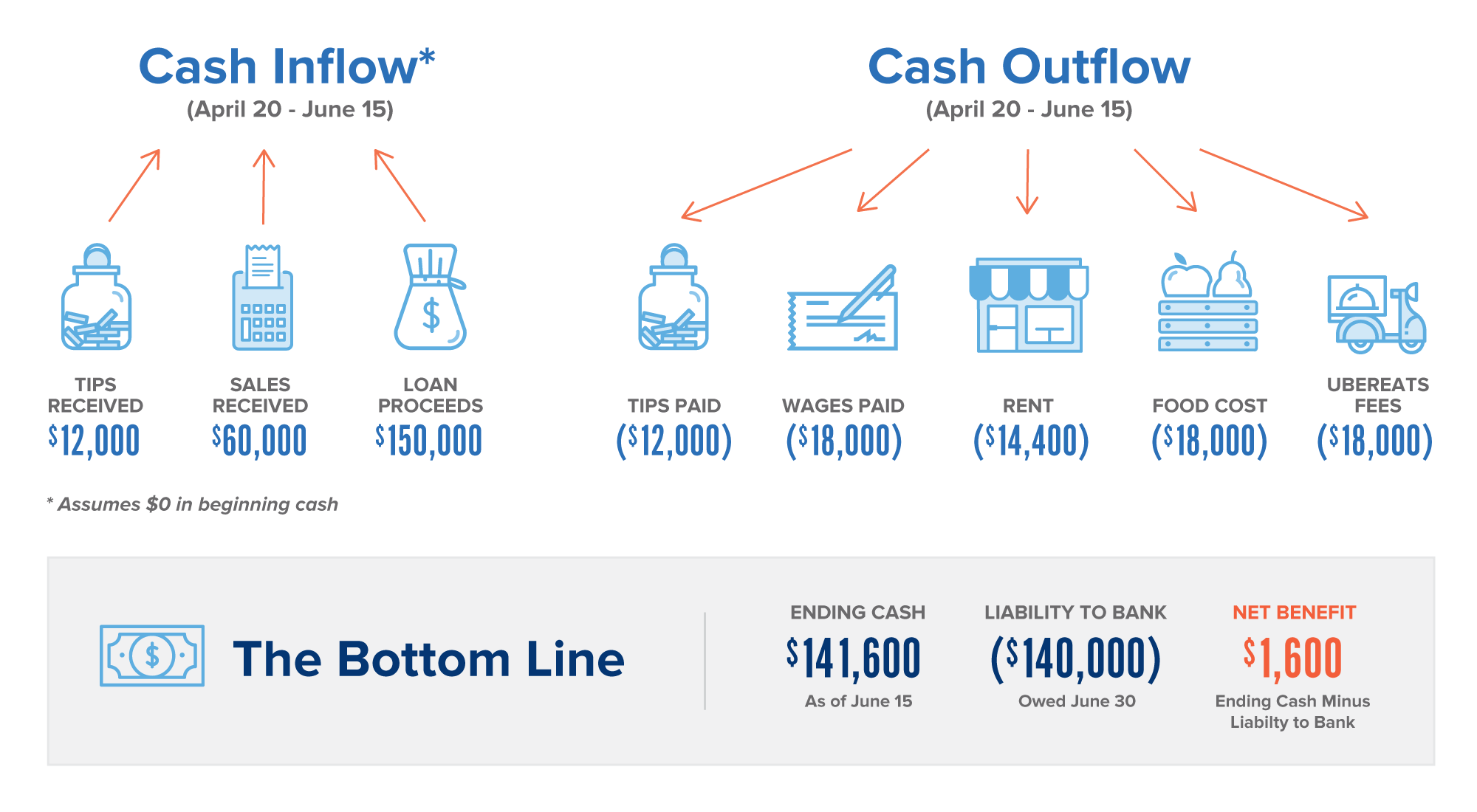

Scenario 1: Partially Open

They have some revenue coming in but by the end of the 8 weeks still only have 5 FTE.

They spent $44.4k (payroll plus rent during the 8-week period following loan) but 75% of that amount must be attributed to payroll so in this case the total amount forgiven would be $40k ($30k divided by .75).

Because their workforce decreased by 75% (20 FTE to 5 FTE) so does their eligibility for forgiveness, so only $10k of the $40k is actually forgiven.

The results over the 8-week period would look something like this:

You can see from the scenario above that staying open for delivery and maintaining a partial workforce results in a nearly break-even situation. The benefit of this scenario is that you have cash on hand at the end of June to re-open your restaurant, and you’ve retained your key players.

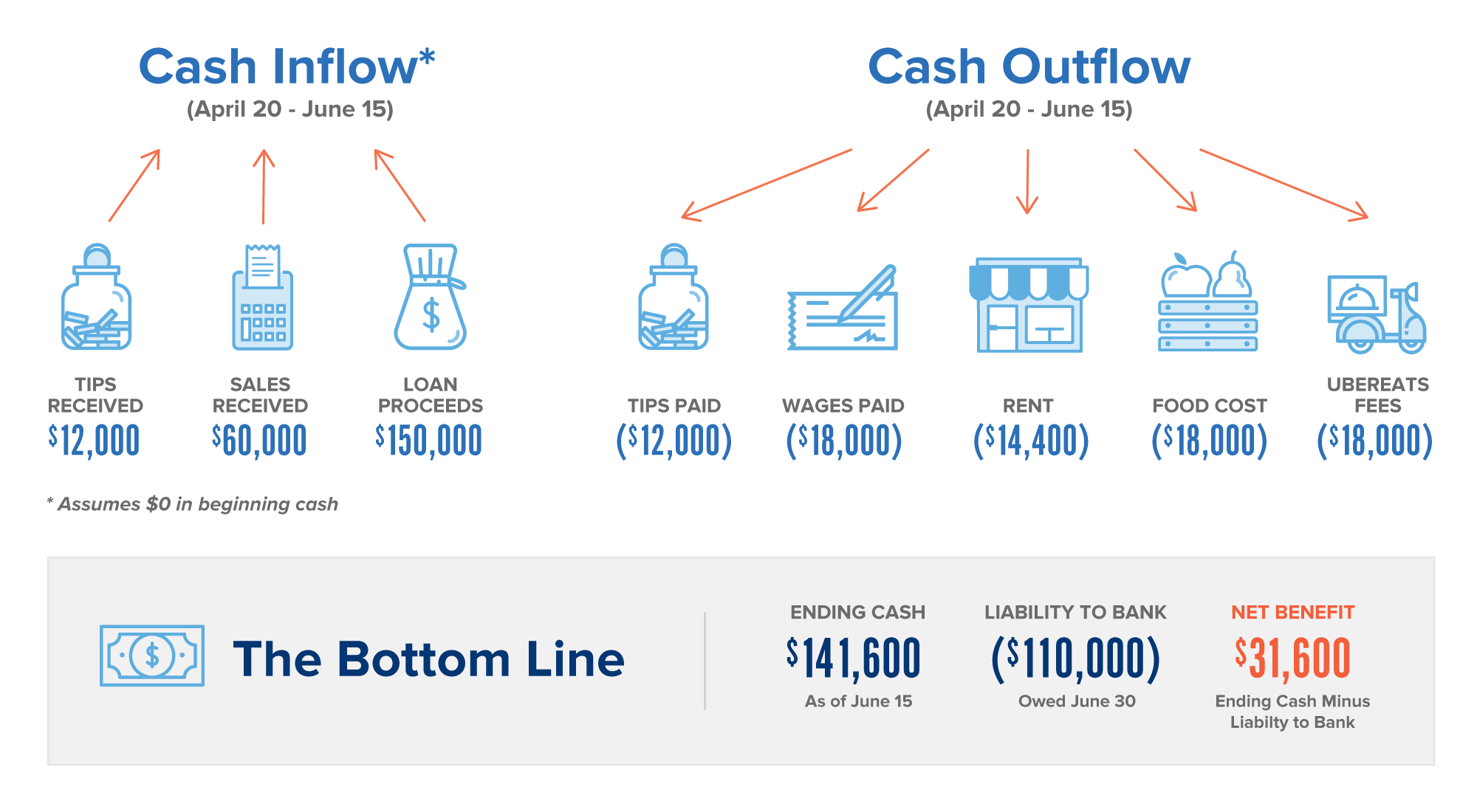

Scenario 2: Partially Open + Rehire Entire Workforce by 6/30

Assume the same facts as Scenario 1, except on June 30 Restaurant A rehires their entire workforce. The result over the 8-week period would look something like this:

Of the $44.4k (payroll plus rent during the 8-week period following loan) amount eligible for forgiveness, 75% must be attributable to payroll thus reducing the amount eligible for forgiveness from $44.4k to $40k. The entire $40k will be forgiven because the entire workforce was rehired as of June 30.

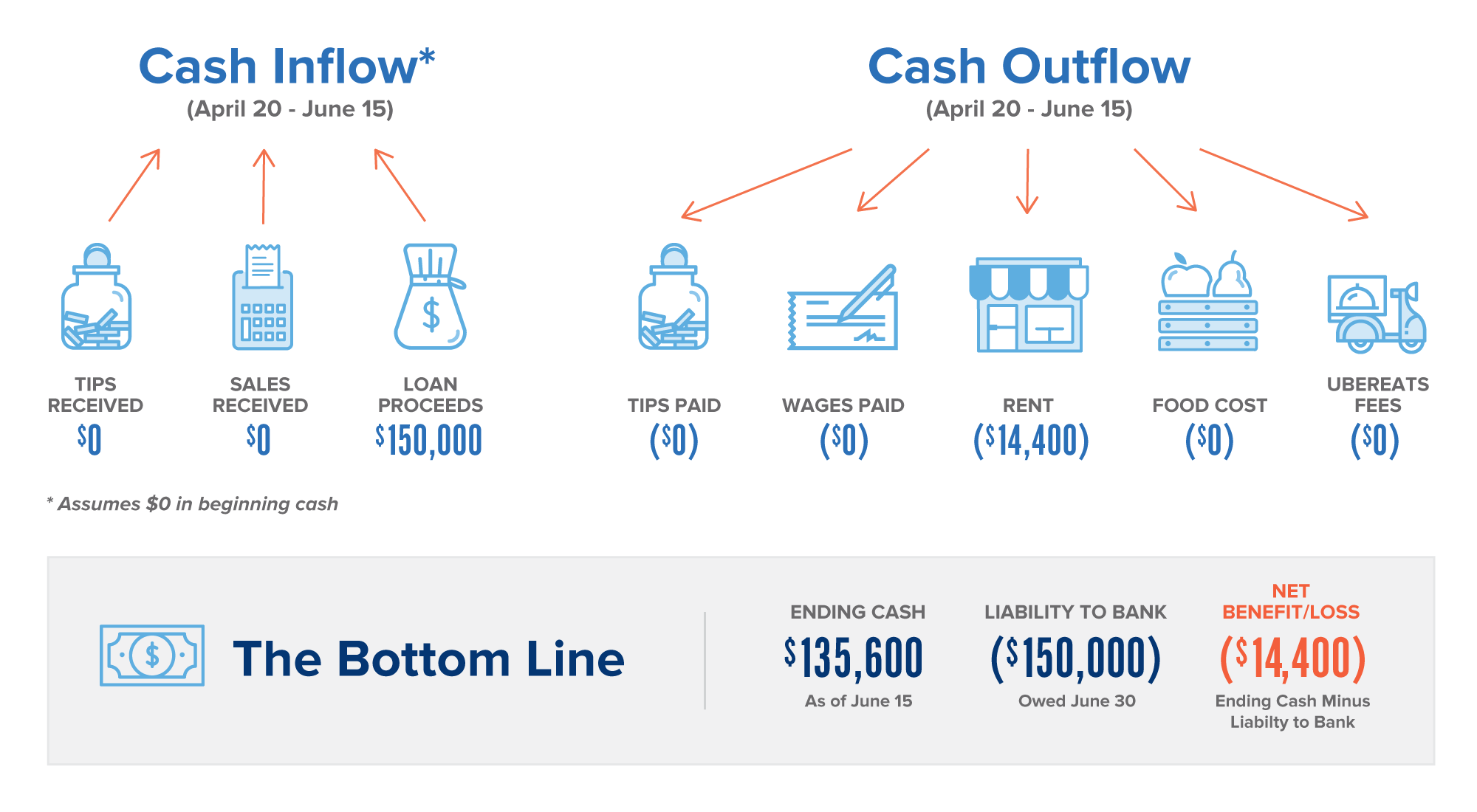

Scenario 3: Complete Shutdown Until Further Notice

Assume the same facts as Scenario 1, except on February 29, the restaurant ceased operations and laid off all employees.

By April 20, they had $0 in cash, but they were awarded $150k (2.5 months average payroll) in PPP loan proceeds on April 20.

Between April 20 and June 15, they spend $0 on payroll and $14.4k on rent. Of the $14.4k (payroll plus rent during the 8-week period following loan) amount eligible for forgiveness, none will be forgiven because nothing was spent on payroll.

The result over the 8-week period would look something like this:

This scenario results in the least favorable situation. You’re left with less cash than scenario 1 and 2, and you owe $150k to the government. It defeats the purpose of the program, however it does still leave you with some low interest cash on hand on June 30 to help you recover when the economy starts moving again.

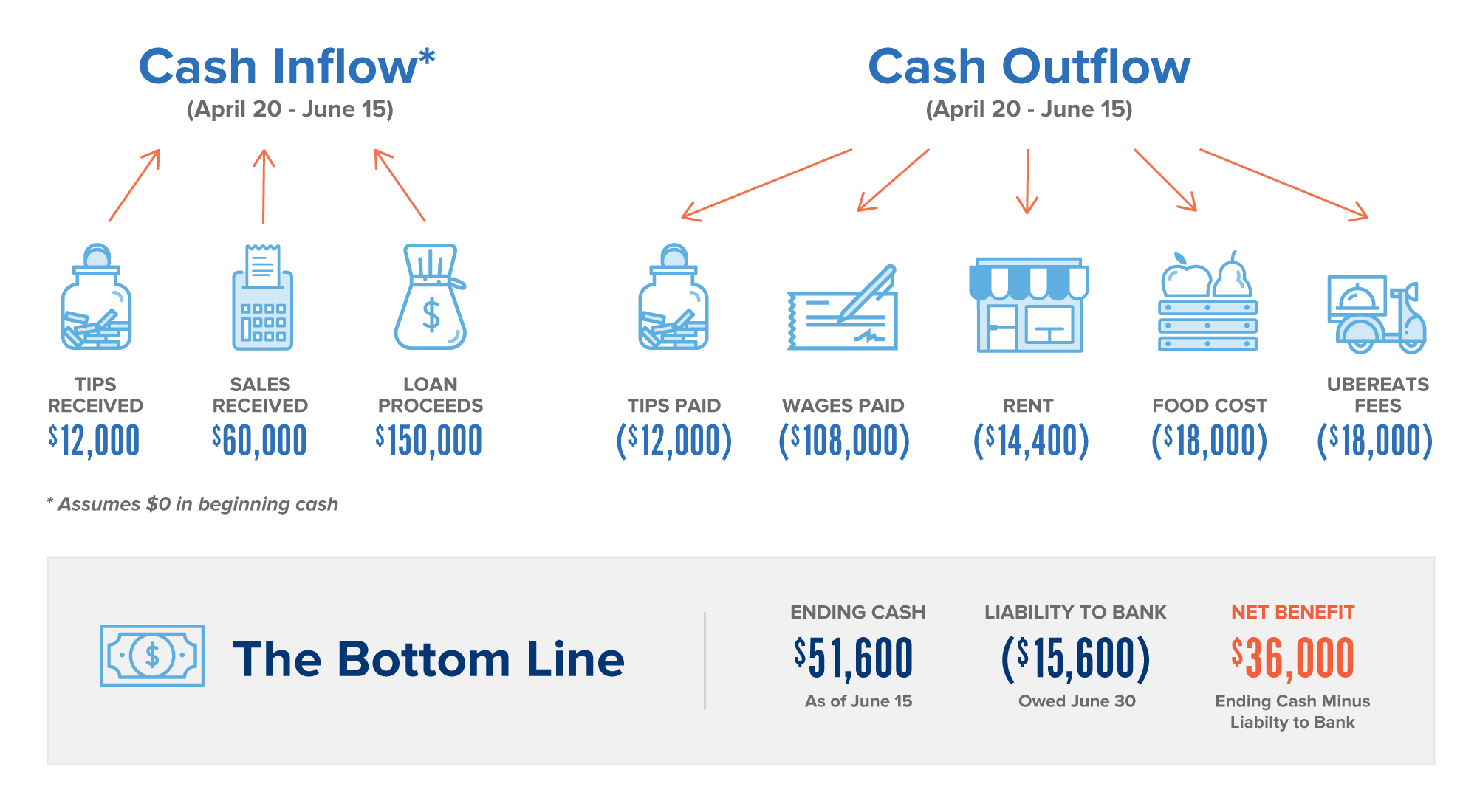

Scenario 4: Partially Open + Rehire Entire Workforce by 4/20

Assume the same facts as Scenario 1, except they rehire their entire workforce on April 20, most of whom stay home or rotate shifts.

Between April 20 and June 15, they spend $120k on payroll and $14.4k on rent.

As a result, the entire $134.4k (payroll plus rent during the 8-week period following loan) will be forgiven.

The result over the 8-week period would look something like this:

In many ways this is the most beneficial scenario; you get to pay your team and get the maximum amount of government assistance. However, if sales don’t rebound, you will be operating at a loss and not have much cash on hand.

If diners are deciding to venture out to restaurants by June 30th, this scenario is golden. If the government reads the tea leaves and extends the rehire date and provides flexibility around the 8-week period, then rehiring your entire staff at the beginning of the 8-week period can again have very favorable results. Otherwise, you will probably be back in the business of making tough calls and laying off your team again. We’re expecting you’ll ask, so we’d like to clarify that the following are not yet certain, and will require further guidance from the Treasury:

- Does “costs incurred and payments made” mean when expenses are accrued or actually paid?

- If funds are received late through a second phase of funding, will amounts expended beyond June 30 within the 8-week period qualify for forgiveness?

- Will non-mortgage interest be forgivable as well since it’s allowed to be paid with loan proceeds?

- Will there be a partial restoration to the reduction in forgiveness if the entire workforce is not rehired by June 30, but only a certain additional percentage is rehired?

So what can we expect next?

There’s no question that restaurants are going to need time to recover and our guess is that the government will recognize that. We hope that Phase 4 of the stimulus will extend the payback/deferral periods and offer some flexibility around the 8-week period.

As you can see, even the most beneficial scenarios result in a lot of uncertainty and debt for restaurants, something Congress and the Treasury did not intend when they enacted this program.

The National Restaurant Association (NRA) is asking Congress to revisit the PPP as it applies to restaurants and provide additional relief, such as:

- Lowering the payroll cap to 50%

- Loosen the 8-week period to allow restaurants to use the proceeds upon fully reopening

- Extend the June 30 rehire date by an additional 30 days

- Extend the maturity date from two years to the originally intended 10 years

- Extend the application date from June 30 to December 31

So what we can expect next is more waiting and watching as Congress works through Phase 4 in real time, more guidance becomes available and more funds make their way to our community. As we learn more we will continue to capture and share.

RYCPAs and MarginEdge will continue to collaborate on resources and updates as we all navigate this together. We have a dedicated team ready to tackle issues related to CARES Act relief, so please don’t hesitate to contact us and if you are not already receiving MarginEdge’s daily email updates, you can sign up here.

RY CPAs is a firm that offers innovative accounting and tax solutions that provide the insight needed to drive profitability and growth for restaurants. RYCPAs’ accounting and advisory team leverages tools like MarginEdge to automate and reduce inefficiencies so they can focus on delivering value to clients. You can learn more about the firm RY CPAs: Tax Accounting Services, and access the latest finance, relief, and tax updates by visiting their blog.

RY CPAs is a firm that offers innovative accounting and tax solutions that provide the insight needed to drive profitability and growth for restaurants. RYCPAs’ accounting and advisory team leverages tools like MarginEdge to automate and reduce inefficiencies so they can focus on delivering value to clients. You can learn more about the firm RY CPAs: Tax Accounting Services, and access the latest finance, relief, and tax updates by visiting their blog.