Editorial: No, the richest Californians don’t need a gas or grocery rebate

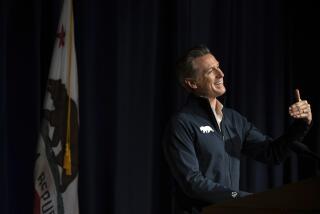

It’s a near certainty that California will dole out some kind of financial relief for residents dealing with soaring prices for gas, groceries and other living expenses. From Gov. Gavin Newsom to Democratic and Republican legislative leaders, there’s almost universal agreement that the state should use some of its estimated $45-billion surplus to send direct payments to people.

The question now is what form that relief will take, who will get it and how quickly the money can get out the door.

Assembly Republicans have even created a bare-bones website with a timer counting the seconds since Newsom’s State of the State speech on March 8, when he floated the idea of a rebate to offset rising gas prices, and asking, “How long will it take Democrats to give you your money back?”

Gov. Gavin Newsom’s proposed tax rebate to help Californians with rising gas prices and inflation should apply to all residents, not just car owners.

The urgency is understandable but the delay has had good results. Each successive tax rebate proposal has been an improvement, and state leaders continue to hone the concept. Newsom is expected to release his latest recommendation this week. California may be flush with cash, but the governor and legislative leaders would still be wise to direct rebate checks to the people who need help the most, namely low- and middle-income families.

Newsom’s initial tax rebate proposal, as described by aides, was problematic because the money would have been limited to car owners. It’s myopic to focus on gas prices when costs for all the essentials, including groceries, child care, clothing and electricity, have shot up as well. And it’s unfair to exclude the carless from relief when so many struggling low-income households can’t afford to own a vehicle.

Legislators have gotten closer to the ideal program to help Californians. First a group of 10 lawmakers pitched a $400 rebate that would go to every taxpayer, rich or poor, who could spend it however they want. Why $400? In theory that would cover the current 51 cents-per-gallon gas tax for one year. The checks would total about $9 billion.

If lawmakers are serious about transportation infrastructure and climate change, they will reject feel-good, do-little proposals to temporarily roll back gas taxes.

Then late last week, Senate President Pro Tem Toni Atkins (D-San Diego) and Assembly Speaker Anthony Rendon (D-Lakewood) floated a better proposal to give $200 to most taxpayers and their dependents, with the payments limited to individual taxpayers with $125,000 or less in taxable income, and up to $250,000 in taxable income for joint filers. About 90% of taxpayers would get checks, and larger families with more dependents would get more relief. The rebates would cost about $6.6 billion, and the leaders also want to create a grant program to give checks to low-income non-tax filers.

If the goal is to help Californians deal with the effects of inflation, then it makes sense to provide direct payments to people most likely to be struggling with higher prices. The richest Californians don’t need a $200 gas or groceries rebate.

California has such a giant budget surplus that under the state’s constitutional limit on spending, known as the Gann limit, a tax rebate may be required anyway. Last year the state worked around that restriction by sending millions of stimulus checks to residents with annual incomes of $75,000 or less to help them cope with the COVID-19 pandemic. This year, California can and should broaden the benefit.

Rebate checks are also a more effective way to help consumers than trying to bring down the price at the pump. Maryland and Georgia have temporarily frozen their gas taxes, and other states are considering the same. In January, Newsom floated the idea of suspending the annual increase to the state’s gasoline and diesel fuel taxes. But he has, wisely, abandoned the idea of a gas tax holiday because there’s no guarantee drivers will see significant savings even if taxes are reduced — global markets and crude oil supply have a much bigger impact on gas prices — and gas taxes pay for transportation projects.

Why sacrifice transportation infrastructure and gamble on gas prices? California should put its generous surplus to good use and give most Californians direct relief, and do it soon.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.