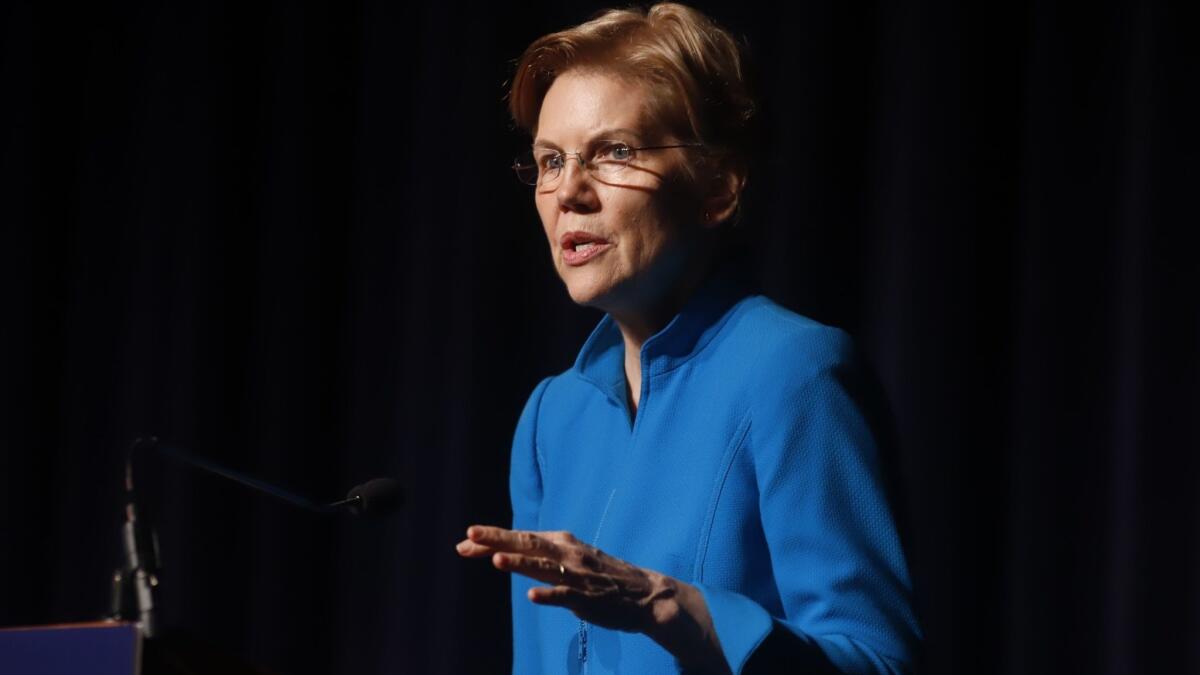

Elizabeth Warren to propose new ‘wealth tax’ on richest Americans, economist says

Sen. Elizabeth Warren (D-Mass.) will propose a new annual “wealth tax” on Americans with more than $50 million in assets, according to an economist advising her on the plan, as Democratic leaders advance increasingly aggressive strategies to reverse the nation’s soaring wealth inequality.

Emmanuel Saez and Gabriel Zucman, two left-leaning economists at UC Berkeley, have been advising Warren on a proposal to levy a 2% wealth tax on Americans with assets above $50 million and a 3% wealth tax on those who have more than $1 billion, according to Saez. Warren announced earlier this month that she has formed an exploratory committee to run for president.

The tax would raise $2.75 trillion over a 10-year period from about 75,000 families, or less than 0.1% of U.S. households, Saez said.

Warren’s campaign declined to comment on details of the plan.

“The Warren wealth tax is pretty big. We think it could have a significant effect on wealth concentration in the long run,” Saez said in an interview. “This is a very interesting development with deep root causes: the fact [that] inequality has been increasing so much, particularly in wealth, and the feeling our current tax system doesn’t do a very good job taxing the very richest people.”

Warren’s proposal includes at least three new mechanisms to combat tax evasion, according to a person familiar with the plan: a significant increase in funding for the Internal Revenue Service; a requirement that a certain number of people who pay the wealth tax to be subject to an audit every year; and a one-time tax penalty for those who have more than $50 million and try to renounce their U.S. citizenship.

Warren’s wealth tax proposal reflects the Democratic Party’s leftward drift on economic policy and tax issues. Democrats have traditionally shied away from proposing how they would raise revenue, for fear of being branded “tax-and-spend” liberals, said Jim Manley, who served as an aide to former Senate Minority Leader Harry Reid (D-Nev).

Saez and Zucman earlier this week published an op-ed in the New York Times about newly elected Democratic New York Rep. Alexandria Ocasio-Cortez’s proposal to raise marginal tax rates to 70% on income above $10 million, a plan the economists said would help combat an “inequality crisis” akin to climate change.

“It’s a pretty dramatic change that shows how much the party has evolved,” Manley said. “It’s not where everyone in the party is now, but it’s an awful lot of people.”

Republicans are likely to seize on the plan as another example of Democrats looking to tax Americans’ hard-earned gains, even though it would apply to only a tiny percentage of the population and only to the portion of their income above the $10-million threshold. In their major tax overhaul passed in December 2017, Republicans significantly hiked the threshold for the federal estate tax — exempting estates with assets of $11.4 million or less from paying it. They have often referred to this provision, which affects a handful of families a year, as the “death tax.”

Saez said the proposal came together quickly over the course of the last two weeks, while adding the economists have spent years considering how to enact a wealth tax.

Saez and Zucman initially evaluated a proposal at Warren’s request to levy a 1% wealth tax on income above $10 million, rather than a 2% wealth tax above $50 million, according to a Jan. 14 letter the economists sent to Warren. That letter was obtained by the Washington Post.

According to people familiar with the matter, Warren’s team has considered multiple proposals with various rates.

In recent decades, the taxation of wealth has fallen out of favor in the world’s richest countries. In 1990, 12 member countries of the Organization for Economic Cooperation and Development imposed some form of wealth tax.

By 2017, that number had fallen to just four: France, Norway, Spain and Switzerland. That decline has been mirrored by a decline in the taxation of high incomes, as well as a rise in inequality, according to the OECD.

The OECD report concludes that the merits of a wealth tax depend in part on how a country taxes capital gains — the income accrued from capital — and estates. Overall, it recommends that “tax exemption thresholds should be high to ensure that the net wealth tax is only levied on the very wealthy,” and that “tax rates should be low and take into account tax rates on capital income to avoid imposing excessively high tax burdens on capital so as to prevent capital flight.”

Estimates of how much money can be raised by taxing the very rich vary dramatically. The Institute on Taxation and Economic Policy, a left-leaning think tank, published a report on Wednesday finding that a 1% wealth tax on the wealthiest 0.1% of Americans (with assets above $33.2 million) would raise $1.3 trillion over a decade.

But conservatives have warned that high taxes on the very rich will stifle growth, lead to capital flight and produce relatively minor revenue gains. Earlier this month, the right-leaning Tax Foundation found that Ocasio-Cortez’s plan for a 70% marginal tax rate would either only raise $189 billion in revenue over 10 years, or lose the federal government $63.5 billion.

The Tax Foundation has also warned against wealth taxes, arguing that “capital accumulation is an essential ingredient for economic growth,” that wealth inequality does not harm the economy and that wealth rewards entrepreneurs who take risks.

Since long before she announced her presidential bid, Warren has been a champion of the working class, arguing that “billionaires and big corporations” have rigged the political and economic system to their advantage. The possibility of a wealth tax proposal comes on top of her plan to force corporations to have 40% of their board of directors selected by company employees, and her support for the Medicare for all plan of Sen. Bernie Sanders (I-Vt.) by nationalizing the health insurance industry.

The wealthiest 1% of families currently face a total tax burden, including state and local taxes, of about 3.2% relative to wealth, Saez and Zucman write in their letter.

The bottom 99% of families currently has a tax burden of 7.2% relative to their wealth, the economists say.

“One of the key motivations for introducing a progressive wealth tax is to curb the growing concentration of wealth,” Saez and Zucman wrote to Warren in their Jan. 14 letter. “The top 1% wealth share has increased dramatically from about 22% in the late 1970s to around 40% in recent years. Conversely, the wealth share of the bottom 95% of families has declined from about 50% in the late 1970s to about 40% today.”

Jeff Stein and Christopher Ingraham write for the Washington Post.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.