Bloomberg Professional Services

Since Bloomberg News began publishing in 1990, there has been explosive growth in news across print, television, and Internet channels. The variety and velocity of information expanded and accelerated rapidly. Within these overwhelming news flows, there are arrays of anomalies, signals, and opportunities. The question is how to capture the most meaningful data using the richest analytics.

The data has outpaced what human analysts alone can handle and at the same time, technology has risen to meet the challenge. Bloomberg has developed technology to monitor markets, discover useful data, and share it through timely, computer-driven stories. With more than 500 templates that produce automated news, Bloomberg Automated Intelligence complements other news sources with additional insights. Bloomberg Terminal users can see automated intelligence stories at Bloomberg News and Bloomberg First Word.

The Bloomberg Quant Research team set out to investigate whether these stories can be meaningfully applied in investment strategies: in short, do they carry signals? In a recent white paper, “Predictive Analysis of Bloomberg Automated Intelligence,” Mohammad Fesanghary and Arun Verma explore some of the analytical opportunities, with intriguing results.

Watching corporate actions: The data tells a story

Automated intelligence encompasses a number of story types, including news analytics that reveal changes in sentiment, reader interest, and trends that are increasingly being used to drive automated news stories. Some story types rely on natural language processing (NLP) to break news in areas from FDA drug approvals to new investor activist campaigns. Automated stories are also triggered by large shifts in traditional financial market data, such as spikes in trading volume, analyst activity, and implied volatility changes from the options market, all of which may be useful in predicting future corporate actions and price movements.

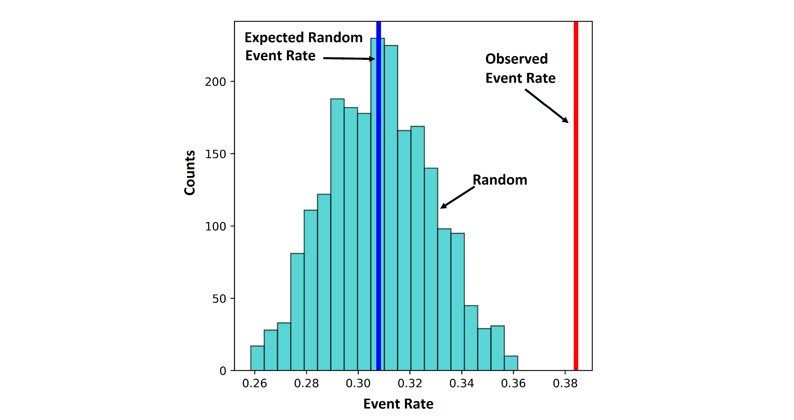

In the paper, the authors examine the types of automated news stories and their publication dates to see if they can be used to predict corporate actions coming in the near future. Anecdotal evidence suggested that the publication of certain types of automated news stories, particularly in combinations, was related to a higher than expected probability of a major corporate announcement. The researchers set out to assess whether this could be a coincidence. They tested this hypothesis by using a non-parametric method to study the predictive power of automated stories by randomizing the publication date of the news and comparing the distribution of those publications with the distribution actually observed. Then, focusing on the occurrence of corporate events and major price movements, if the observed rate of publication of a given news type is substantially different from the randomized rate, then that news type would appear to carry some signal.

The results reveal that automated stories have been ahead of major announcements by companies across a diverse set of industries. In particular, corporate actions such as M&A follow certain combinations of automated stories far more often than would be expected in a random sampling. For example, when signals on insider buying, implied volatility and active bond trading are published close together, they precede M&A announcements 16.7% of the time, more than triple the expected rate. Analyzing the dynamics across a range of news sources, there is also evidence that so-called “social velocity” and “news heat” can carry a fairly strong signal.

Time will tell: Continued research and testing to come

This study was partly prompted by anecdotal information suggesting that certain combinations of automated news stories tended to precede market-moving events. But what can be said about the predictive power of single stories? The study found that using a single automated story to predict major price movements is more difficult. On the other hand, they tend to be triggered after the start of a major price move but are still timely enough, as they are available before the end of the entire price move, which could still lead to an effective momentum-based trading strategy.

The triggering mechanisms for some types of automated stories are evolving over time, so the system is not stationary across the board. This could introduce bias and merits further examination. The time horizon for this first study was just 18 months, so any strategies that could be developed will benefit from longer term observation and more testing.

Download the report to learn more about the research and read the full conclusions.

This article was originally published on June, 29, 2020.