Bacon sales down as shoppers choose fish

- Published

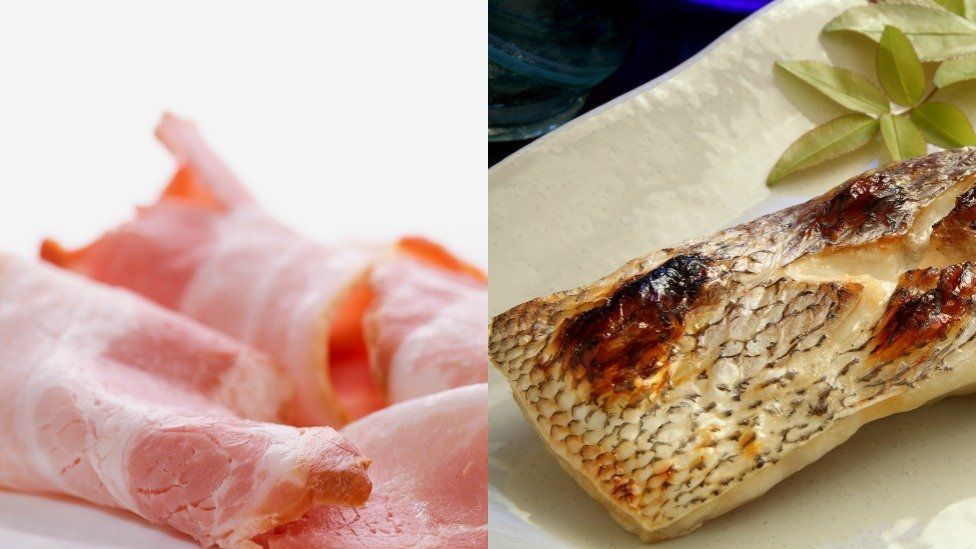

Bacon sales have plummeted as shoppers choose fish over meat for their meals, industry data has suggested.

Meat sales were down by £300m in 2016, a report by The Grocer said, while pre-prepared fish sales were up by over £30m.

It said health warnings such as those linking processed meats to cancer had played a part.

Fruit and vegetable sales were also up, driven by the popularity of avocados, blueberries and raspberries.

The number of people buying fresh meat in supermarkets has dropped by 4.4% throughout the year, according to the report based on data from Nielsen, but no product has been hit as hard as pork.

Bacon sales dropped by over £122m during the 12 months, whilst sausage sales declined by £51m.

Richard Esau, marketing director of Tulip - a meat supply chain company - said a report by the World Health Organisation linking processed meats to cancer had played a part.

"People are trying to eat less but higher quality meat," he said. "The challenge for bacon is to emulate sausages, which have seen fantastic growth at the premium end."

Chicken managed to see a small rise in sales of 0.3% - equivalent to an extra £2.2m.

In meat's place, fresh fish sales have seen a rise, with pre-prepared products, up by over £30m and smoked salmon up by £6.9m.

'From the counter' fish did not fare as well, with a £26.6m drop, and frozen fish saw a 2.1% drop in sales, with seven of the top 10 sellers seeing a fall.

But producers said with a focus on more premium products, there was hope of recovery in the market.

Yvonne Adam, marketing director at Young's Seafood, said: "While there is some switching to chilled fish, frozen fish is outperforming frozen food in general.

"There is significant growth in some categories of frozen fish as more and more people look to frozen, or trade up, for value and quality."

Prosecco price hike

Sales of avocados, blueberries and raspberries helped boost the fruit and vegetables market, with a £175.6m increase on 2015.

And whilst still behind its biggest rival, Pepsi saw a rise in sales of 7.1% (£29.6m), compared to a £48.2m fall for Coca Cola.

But there was some bad news for consumers.

A poor harvest in southern Europe, alongside currency fluctuations, means a predicted price rise in olive oil next year. Tomatoes have already seen a price hike of 10% and Prosecco prices are looking likely to rise in 2017.

The report added that several years of food deflation were at an end, with a return to inflation "inevitable" because of a drop in the value of Sterling.

Tesco still dominated the supermarket share, holding 27.6% of the market (down by 0.1% on 2015), but the budget supermarkets continued to improve.

Aldi's share rose by 15.7% to account for 7.1% of the market in 2016, whilst Lidl was up by 11.5% from last year to account for 4.6%.

Asda saw the biggest loss of market share for the year, down by 5.2% to 14.5%.

- Published21 December 2016

- Published1 November 2016

- Published2 August 2016

- Published26 October 2015

- Published19 November 2015