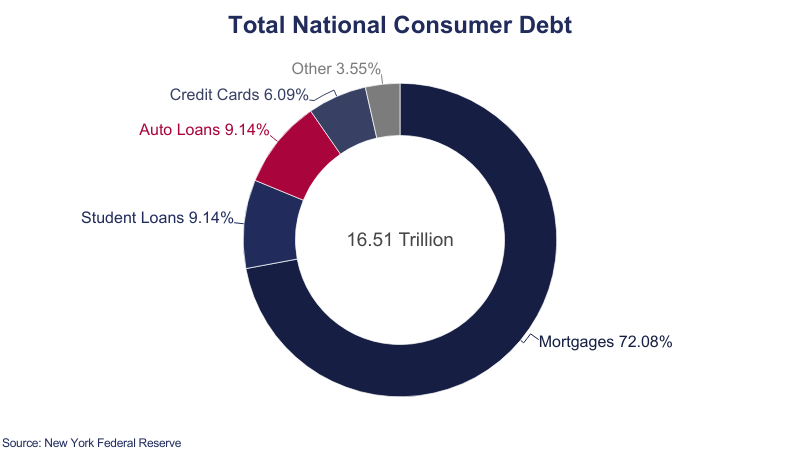

Report Highlights. Student loan debt makes up the 2nd largest amount of debt in the nation behind mortgages.

- Student loan debt in America has increased by $14 billion since last year.

- Mortgages in the U.S. have increased by $864 billion since last year.

- Auto loan debt in America has increased by $93 billion since last year.

- Credit card debt in the U.S. has fallen by $145 billion since last year.

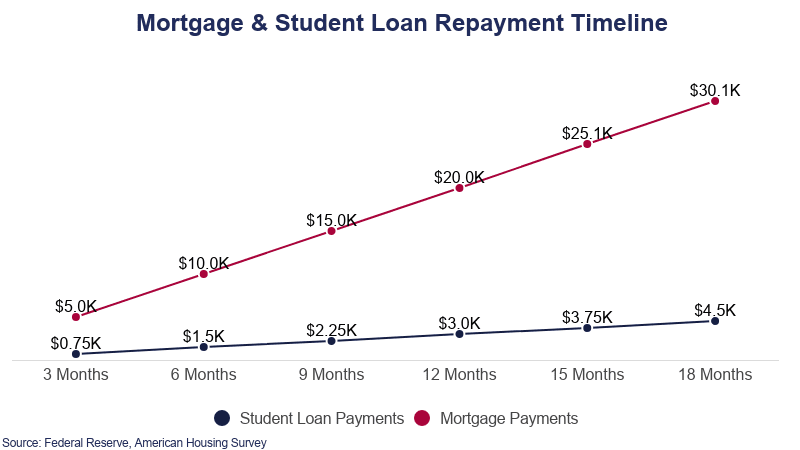

Student Loan Debt vs Mortgage Debt

Student loans account for 9% of the total national debt while mortgages account for most of the national debt at 71%. Mortgages dwarf student loans in size on the individual, state, and national scale. The repayment terms of a mortgage are also lengthier than the average student loan.

- The national student loan debt is $1.6 trillion.

- Nationally, mortgages represent $12 trillion of all debt.

- The national mortgage is approximately 7.5 times larger than the student loan debt.

Repayment Terms

A significant reason mortgages account for the majority of the national debt is because of the extended length of their repayment period. In a typical fixed-rate mortgage, payments are determined by the loan amount, the loan term, and the interest rate. Student loans are considered on a similar basis.

- Typical standard repayment plans for federal student loans and private student loans take a total of 10 years to pay off.

- For mortgages, the 30-year option tends to be the most popular.

- The average student loan debt is $36,720.

- The average mortgage is $232,300.

- The average mortgage is nearly 6.3 times larger than the average student loan debt.

- The typical monthly payment of a mortgage is $1,672.

- The typical monthly payment on a student loan is between $200 and $299.

State Comparisons

In the American Housing Survey, the Census Bureau measured the mortgage characteristics of the average U.S. Home. The table below compares a state’s average student loan debt with its average mortgage. Only 10 states had their average mortgage available.

- California’s average mortgage is $149,300 more than the national average.

- California’s average mortgage is nearly 10 times larger than its average student loan.

- Ohio has the lowest average mortgage at $113,500.

- Texas has the lowest average student loan debt at $32,800.

- Ohio’s mortgage is nearly 3.9 times larger than Texas’ student loan.

| State | Student Loan Debt | Mortgage |

|---|---|---|

| California | $37,084 | $381,600 |

| Colorado | $36,822 | $237,900 |

| Florida | $38,459 | $223,100 |

| Illinois | $37,757 | $200,100 |

| Massachusetts | $34,146 | $320,800 |

| New York | $37,678 | $279,500 |

| Ohio | $34,721 | $113,500 |

| Pennsylvania | $35,385 | $192,900 |

| Texas | $32,920 | $220,200 |

| Virginia | $39,165 | $252,800 |

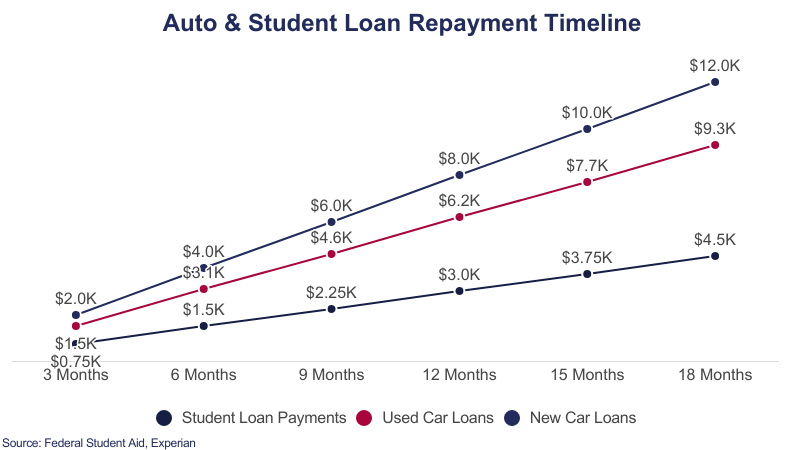

Student Loan Debt vs Auto Loan Debt

Auto loans make up the 3rd largest form of the national debt, directly behind student loan debts. Auto loans tend to have higher fixed interest rates than federally backed student loans. Because federal student loans offer flexibility and loan forgiveness, it is suggested individuals pay off their auto loans first.

- Student loans make up $1.6 trillion of the total national debt.

- Auto loans at $1.56 trillion make up 9% of the national debt.

- The national student loan debt is $40 billion more than the auto loan debt.

Repayment Terms

Monthly car payments are determined by the individual’s credit score along with other variables. The major difference between auto loans and student loans is in the use of credit scores. Student loans backed by the government do not take credit scores into account.

- The average auto loan is $22,612.

- The average student loan debt is $36,720.

- The average student loan debt is $14,108 larger than the average individual auto loan.

- The typical monthly payment for a car is $493.

- The typical monthly payment on a student loan is between $200 and $299.

State Comparisons

The average auto loan increased in all 50 states from 2020 to 2021. Despite the disruption in travel due to COVID-19 the average auto debt still increased over the year. Student loan debt decreased for the first time in 2022 after the suspension of interest on federal student loans.

- Rhode Island has the lowest average auto loan debt at $15,485.

- Wyoming has the highest average auto loan debt at $25,522.

- The District of Columbia’s student loan debt is $38,536 more than its auto loan debt.

| State | Student Loan Debt | Auto Loan Debt |

|---|---|---|

| Alabama |

$37,137 |

$24,127 |

| Alaska |

$33,024 |

$25,846 |

| Arizona |

$35,396 |

$24,946 |

| Arkansas |

$33,333 |

$25,418 |

| California |

$37,084 |

$23,268 |

| Colorado |

$36,822 |

$23,228 |

| Connecticut |

$35,162 |

$18,491 |

| Delaware |

$37,559 |

$21,585 |

| District of Columbia |

$55,945 |

$20,003 |

| Florida |

$38,459 |

$23,412 |

| Georgia |

$41,639 |

$24,673 |

| Hawaii |

$36,765 |

$22,350 |

| Idaho |

$33,012 |

$24,339 |

| Illinois |

$37,757 |

$21,433 |

| Indiana |

$32,874 |

$21,078 |

| Iowa |

$30,464 |

$22,029 |

| Kansas |

$32,578 |

$22,551 |

| Kentucky |

$32,779 |

$21,909 |

| Louisiana |

$34,525 |

$26,438 |

| Maine |

$33,137 |

$20,252 |

| Maryland |

$42,861 |

$22,809 |

| Massachusetts |

$34,146 |

$18,205 |

| Michigan |

$36,116 |

$18,038 |

| Minnesota |

$33,604 |

$20,098 |

| Mississippi |

$36,902 |

$24,530 |

| Missouri |

$35,397 |

$21,588 |

| Montana |

$33,149 |

$23,309 |

| Nebraska |

$31,919 |

$21,367 |

| Nevada |

$33,743 |

$24,816 |

| New Hampshire |

$33,085 |

$19,774 |

| New Jersey |

$35,434 |

$19,228 |

| New Mexico |

$34,211 |

$26,622 |

| New York |

$37,678 |

$19,090 |

| North Carolina |

$37,721 |

$22,642 |

| North Dakota |

$28,604 |

$23,758 |

| Ohio |

$34,721 |

$19,658 |

| Oklahoma |

$31,525 |

$25,657 |

| Oregon |

$37,017 |

$21,684 |

| Pennsylvania |

$35,385 |

$19,913 |

| Rhode Island |

$32,056 |

$17,798 |

| South Carolina |

$38,414 |

$22,392 |

| South Dakota |

$30,954 |

$22,113 |

| Tennessee |

$36,418 |

$23,878 |

| Texas |

$32,920 |

$27,739 |

| Utah |

$32,835 |

$23,270 |

| Vermont |

$36,516 |

$19,839 |

| Virginia |

$39,165 |

$22,355 |

| Washington |

$35,510 |

$23,754 |

| West Virginia |

$31,690 |

$24,382 |

| Wisconsin |

$31,894 |

$19,826 |

| Wyoming |

$31,250 |

$27,166 |

Student Loan Debt vs Credit Card Debt

The overall national credit card debt dropped in 2020. In contrast, student loan debt rose in the same year. The average student loan debt may be much higher, yet the monthly payments for both debts are nearly the same.

- Student loans make up $1.6 trillion of the total national debt

- Credit Card debt at $986 billion makes up 6% of the national debt.

- The national student loan debt is $614 billion more than the credit card debt.

Repayment Terms

Experts suggest paying off credit card debt first because of the higher interest rate on credit cards. Credit card debts do not offer repayment plans based on income, ability to pay, financial payments, or deferred payments, unlike student loans.

- The average student loan debt is $36,720.

- The average student loan is nearly 4.1 times larger than the average credit card debt.

- Credit cards can often carry an interest rate of over 20%.

- Federal student loans usually have an interest rate below 10%.

- The typical monthly payment on a student loan is between $200 and $299.

- Payment on average for the monthly credit card bill is $244.

State Comparisons

The states with the highest average credit card debt in 2019 saw the greatest decreases in 2020. In contrast, average student loan debts increased across all 50 states.

- While not a state, Washington D.C. saw credit debt shrink by 20% in the past year.

- In Georgia, student loan debt is $35,946 more than credit card debt.

- Alaska had the highest increase in student loan debt at 6.8%.

- Alaska has the highest average credit card debt at $6,617.

- Iowa has the lowest average credit card debt at $4,289.

| State | Student Loan Debt | Household Credit Card Debt |

|---|---|---|

| Alabama |

$37,137 |

$7,791 |

| Alaska |

$33,024 |

$11,277 |

| Arizona |

$35,396 |

$7,906 |

| Arkansas |

$33,333 |

$7,214 |

| California |

$37,084 |

$8,505 |

| Colorado |

$36,822 |

$8,906 |

| Connecticut |

$35,162 |

$9,088 |

| Delaware |

$37,559 |

$8,360 |

| District of Columbia |

$55,945 |

$5,671 |

| Florida |

$38,459 |

$8,510 |

| Georgia |

$41,639 |

$8,699 |

| Hawaii |

$36,765 |

$10,190 |

| Idaho |

$33,012 |

$7,442 |

| Illinois |

$37,757 |

$7,874 |

| Indiana |

$32,874 |

$6,932 |

| Iowa |

$30,464 |

$6,458 |

| Kansas |

$32,578 |

$7,553 |

| Kentucky |

$32,779 |

$6,994 |

| Louisiana |

$34,525 |

$8,003 |

| Maine |

$33,137 |

$7,091 |

| Maryland |

$42,861 |

$9,120 |

| Massachusetts |

$34,146 |

$8,116 |

| Michigan |

$36,116 |

$7,134 |

| Minnesota |

$33,604 |

$7,215 |

| Mississippi |

$36,902 |

$7,297 |

| Missouri |

$35,397 |

$7,402 |

| Montana |

$33,149 |

$7,614 |

| Nebraska |

$31,919 |

$6,956 |

| Nevada |

$33,743 |

$7,909 |

| New Hampshire |

$33,085 |

$8,427 |

| New Jersey |

$35,434 |

$8,956 |

| New Mexico |

$34,211 |

$7,521 |

| New York |

$37,678 |

$8,214 |

| North Carolina |

$37,721 |

$7,752 |

| North Dakota |

$28,604 |

$7,080 |

| Ohio |

$34,721 |

$7,192 |

| Oklahoma |

$31,525 |

$8,136 |

| Oregon |

$37,017 |

$7,477 |

| Pennsylvania |

$35,385 |

$7,690 |

| Rhode Island |

$32,056 |

$7,787 |

| South Carolina |

$38,414 |

$8,221 |

| South Dakota |

$30,954 |

$7,152 |

| Tennessee |

$36,418 |

$7,677 |

| Texas |

$32,920 |

$8,681 |

| Utah |

$32,835 |

$8,527 |

| Vermont |

$36,516 |

$7,351 |

| Virginia |

$39,165 |

$9,176 |

| Washington |

$35,510 |

$8,085 |

| West Virginia |

$31,690 |

$7,207 |

| Wisconsin |

$31,894 |

$6,553 |

| Wyoming |

$31,250 |

$7,975 |

Student Loan Debt vs Other Assorted Debts

The remaining 3% of the national debt is made up of a compilation of sources. There is some overlap in these debts with other debts. For example, an individual may pay off their medical debt using a credit card.

- Roughly 50% of students with medical school debt in 2022 owe more than $2,000.

- Revolving debts are roughly $339 billion of the national debt.

- If all U.S. citizens had revolving debt, it would be $1,021 per person.

Sources

- Federal Reserve Bank of New York, Center for Microeconomic Data: Household Debt and Credit Report

- The Federal Reserve (The Fed): Report on the Economic Well-Being of U.S. Households in 2019 – May 2020

- Consumer Financial Protection Bureau (cfpb): How long does it take to pay off a student loan?

- Educationdata.org: Student Loan Debt by State

- Experian: U.S. Auto Debt Grows to Record High Despite Pandemic

- Northwestern University, Financial Wellness: Credit Cards vs. Student Loans

- American Housing Survey Table Creator

- The burden of medical debt in the United States – Peterson-KFF Health System Tracker

- 2022 Credit Card Debt Study: Trends & Insights

- Average Monthly Debt Payments Throughout the U.S. | LendingTree

- Federal Student Loan Portfolio